401k withdrawal tax rate calculator

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. LocalCity Income Tax Rate.

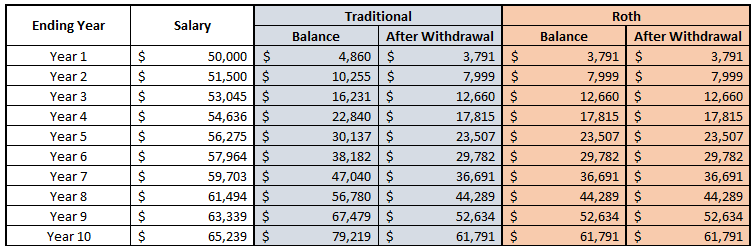

Traditional Vs Roth Ira Calculator

For example if interest is taxed at the rate of 15 you can calculate a tax-adjusted interest rate as 1-rate15.

. How much tax will I pay on a 401K withdrawal. Discover your 401k Rollover Options. Buying a House With 401K.

That is usually a pretty good assumption but if you want to take taxes into account you can use a tax-adjusted interest rate. The 529 Plan Contributions allows tax deductions in certain states currently the Tax Form Calculator only applies this tax credit in Indiana please contact us if your State provides 529 Plan Contributions tax credits and we will integrate it into this tool. Were here to help Call 866-855-5635 Chat.

Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling. You also need to take inflation into account. 401K and other retirement plans.

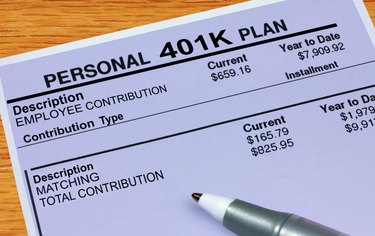

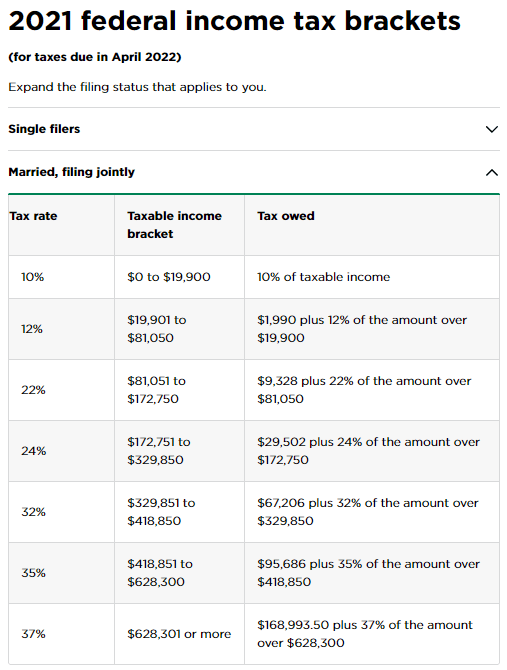

Because you dont pay taxes on your contributions your withdrawals will be taxed at your ordinary income rate in retirement. If you are under 59 12 you may also be subject to a 10 early withdrawal penalty. A pre-tax 401k is an incredible opportunity to put your hard-earned money to work.

You pay income tax on the entire amount of your withdrawal. Federal Income Tax Rate. Based on your effective tax assumption of 15 your annual after-tax income is.

State Income Tax Rate The percentage of taxes an individual has to pay on their income according to the laws of their state. 202223 Tax Refund Calculator. Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties.

You pay capital gains tax on your gain at withdrawal. Gross 401K Withholding Gross IRA Deductions Withholdings. But if you withdraw money from your 401k prior to age 59½ not only will you have to pay taxes youll also be hit with a 10 percent penalty.

An average growth rate of a market portfolio grows by 7 annually. Balance would then be reduced by your tax rate in retirement whereas the Roth 401k balance would remain whole. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

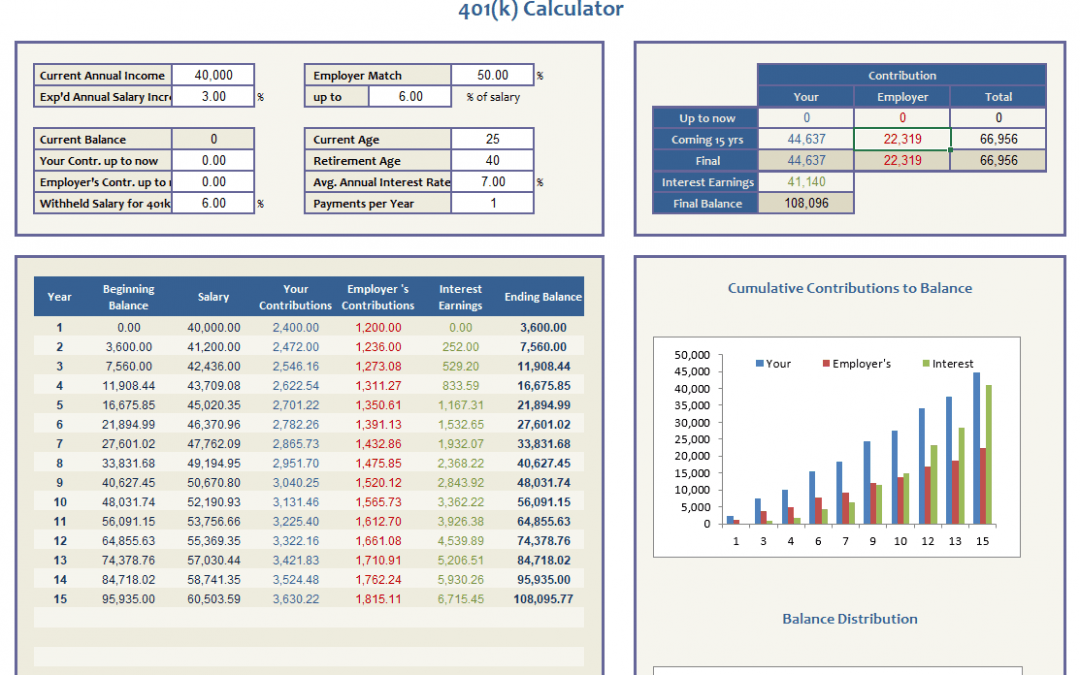

However you can take. 1 online tax filing solution for self-employed. Simple 401k Calculator Terms Definitions.

Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code.

Withdrawing the amount from 401k may lower the mortgage payments by around 1 but you also do not earn interest of around 7 on the money withdrawn in addition to the 10 withdrawal penalty. You may also face early withdrawal penalties. Use this 401k calculator to see where you are.

Self-Employed defined as a return with a Schedule CC-EZ tax form. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income. This first calculator shows how your balance grows during your working years.

If you return the cash to your IRA within 3 years you will not owe the tax payment. IRA and 401K Calculator. The math behind the calculator This calculator uses your input allocation percentages and rate-of-return for each to calculate a weighted-average rate-of-return for your net worth as it.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. This increase in the cost of things we purchase typically comes out to about 2 to 3 a year and it can significantly affect your retirement moneys purchasing power. Use our Retirement Savings Calculator.

State Income Tax Rate. How to Work 401k Pre-tax Dollars to Your Advantage. This 4 withdrawal rate was found by the Trinity Study to have a 100 success rate over a 30-year retirement horizon with a 50 50 mix of stocks and bonds.

Estimate your marginal state income tax rate your tax bracket based on your current earnings including the amount of the cash withdrawal from your retirement plan. Weve planned it such that your overall income over time will increase at rate of inflation of 2. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider.

The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Transferring tax advantages fees and more. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal.

Calculate your total tax due using the tax calculator updated to. For example if you start contributing to a pre-tax 401k and put 5000 in the account through payroll contributions you wont have to pay income tax on that 5000 when tax season rolls around. However future withdrawal amounts will largely depend on whether your investments meet your long-term growth assumption of 6.

The tax advantage of the 401k. Roth 401k withdrawal rules. Money withdrawn will be taxable and subject to a mandatory 20 federal withholding rate.

Withdrawing money from a qualified retirement plan such as a Traditional IRA 401k or 403b plans among others can create a sizable tax obligation. 55 or older If you left your employer in or after the year in which you turned 55 you are not subject to. This is another thing that the spreadsheet does not take into account.

Use this calculator to see what your net withdrawal would be after taxes and penalties are taken into account. This 401k Early Withdrawal Calculator will help you compare the consequences of taking a lump-sum distribution from your 401k or even your IRA versus rolling it over to a tax-deferred account. Americas 1 tax preparation provider.

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

What Is The 401 K Tax Rate For Withdrawals Smartasset

401k Calculator Discount 57 Off Www Wtashows Com

How To Calculate Taxes Owed On Hardship Withdrawals 13 Steps

How To Calculate The Income Taxes On A 401 K Withdrawal Sapling

/thinkstockphotos-152173891-5bfc353d46e0fb0051bfa959.jpg)

How To Calculate Early Withdrawal Penalties On A 401 K Account

Tax Withholding For Pensions And Social Security Sensible Money

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

401k Calculator

Roth Vs Traditional 401k Calculator Pensionmark

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Who Should Make After Tax 401 K Contributions Smartasset

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

How Much Is Your 401k Taxed After Retirement 2022

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal